401k loan calculator fidelity

Your 401k is your money and making a withdrawal is as simple as contacting Fidelity to let them know you want it. Call 800-343-3543 with any questions about the process.

After Tax 401 K Contributions Retirement Benefits Fidelity

Find advanced calculator options here.

. Some employers even offer contribution matching. Well break down this list of best funds into three categories. However you can also reach out via phone if you prefer.

Fidelity offers many high-quality mutual funds which makes it tough to choose the best ones for you. It is as if Ryan only made 50000 a year because he is only required to pay taxes on 50000. Salaries reviews and more - all posted by employees working at Fidelity Investments.

Contribute to your 401k. If the loan is not paid back your former employer 401k plan administrator may treat it as a loan offset rather than a deemed distribution. Fidelity customers who receive the mail offer will earn a 150 bonus for spending 1500 within the first 90 days.

This is an optional tax refund-related loan from MetaBank NA. Non-Roth Solo 401kthe 10000 deferral is treated as pre-tax thereby reducing Ryans income by 10000 to 50000. In that case the amount of the loan is subject to taxes and possibly penalties.

The easiest way is to simply visit Fidelitys website and request a check there. Also due to the time value of money and the. Approval and loan amount based on expected refund amount eligibility criteria and underwriting.

Loans are offered in amounts of 250 500 750 1250 or 3500. See how your balance stacks up to the average 401k balance by age according to Fidelity. Try to meet or exceed their matching amount to make the most of your retirement savings.

It offers 2 cash back on every eligible net. Elevate your Bankrate experience. Making a Fidelity 401k Withdrawal.

Loan repayment PTO and the Charitable match are also unique. Under the Tax Cut Jobs Act that came into effect in 2018 these. Because an employer-sponsored 401k retirement account allows you to grow your assets tax-deferred their long-term savings potential is quite high.

Best Actively Managed Funds Best Index Funds and Best Balanced Funds. Roth Solo 401k The facts are the same as above except that Ryan chooses to treat the 10000 deferral as a Roth contribution. Before you decide what to do with your 401k make sure you dont have a loan on your 401k.

If you withdraw money from your traditional IRA before age 59 12 theres a 10 early withdrawal penalty and that is in addition to the income tax due on each withdrawal. The Fidelity Credit Card 200 bonus offer is not available as of September 2020 though there is a targeted sign-up bonus offer worth up to 300. Plus Fidelity is great for low account fees and offers free stock and ETF trades too.

You may be able to do this online with entities such as PayPal or Charles Schwab. However you can take. If you receive services from other financial agencies including a credit union a credit reporting agency PayPal an IRA401k administrator andor an investment account holder give them a heads up about your new address so you dont miss anything important.

Age 59 12 is the magic number when it comes to avoiding the penalties associated with early 401k withdrawals. Fidelity Fund Types. Can he roll over his annuity into my 401k to.

It can be hard to know if your retirement savings are on track but comparing your balance to others can help. You can take penalty-free withdrawals from 401k assets that have been rolled over into a traditional IRA when youve reached this age. Input just a few basic numbers such as age annual savings annual.

It is not your tax refund. Durham nci was offered 115k20bonusfrom second year 401k 7 match10 profit sharing in 401k7500 bonus. Be informed and get ahead with.

401k loans are appealing because they dont affect your debt-to-income ratio however if you cant repay it by the tax due date after leaving your job youll be taxed on the balance and charged an early withdrawal fee. For many a 401k is the cornerstone of retirement. The reason youre permitted to roll over these payments into an annuity tax-free is because when you buy an annuity with IRA or 401k money the first thing the insurance company does is create an IRA holding account to receive your transferred funds.

As of 2020 the 401k contribution limit for those aged 50 and below is 19500. Student loan calculator. The Fidelity myPlan Snapshot enables you to get a glimpse into your retirement finances in seconds.

Standard pricing for mutual funds. In particular taking a look at the average 401k balance by age is a good place to start. Withdrawals After Age 59 12.

Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more. I understand that you have an outstanding 401k participant loan under your former employer plan. If youre seeking simple and generous cash-back rewards the no-annual-fee Fidelity Rewards Visa Signature Credit Card is a great choice.

Free for Fidelity funds and 4995 on the buy and 0 to sell transaction. See what employees say its like to work at Fidelity Investments. If your employer offers a 401k plan consider contributing pre-tax money with every paycheck.

How To Process A Fidelity Investments Conversion Of Voluntary After Tax Solo 401k Funds Non Prototype Account To A Fidelity Roth Ira My Solo 401k Financial

Fidelity Go Review Pros Cons And Who Should Set Up An Account

Average 401 K Account Balance By Age Vs Recommended Balances For A Comfortable R Retirement Planning Finance Average Retirement Savings Saving For Retirement

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

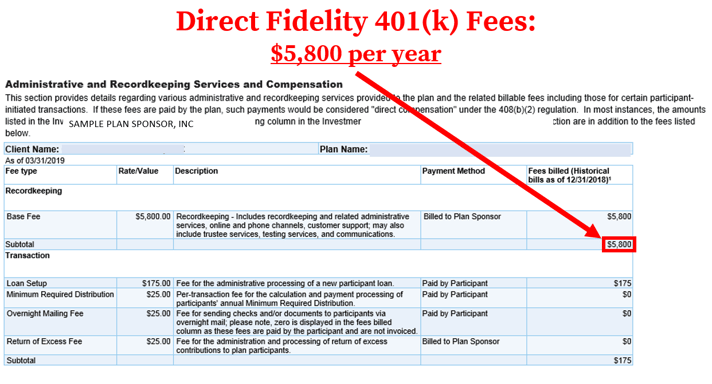

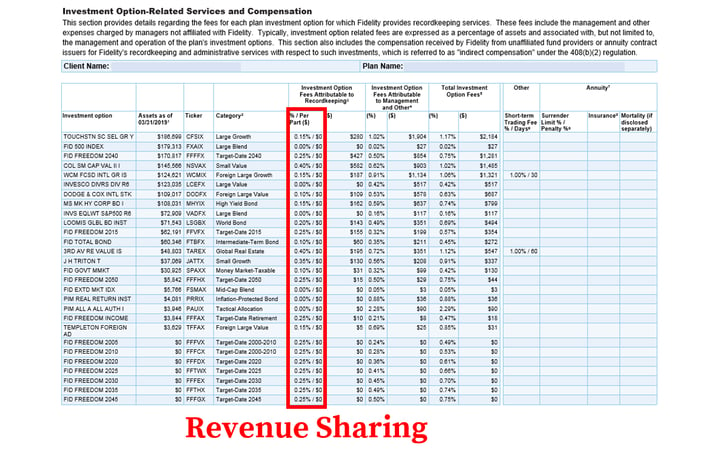

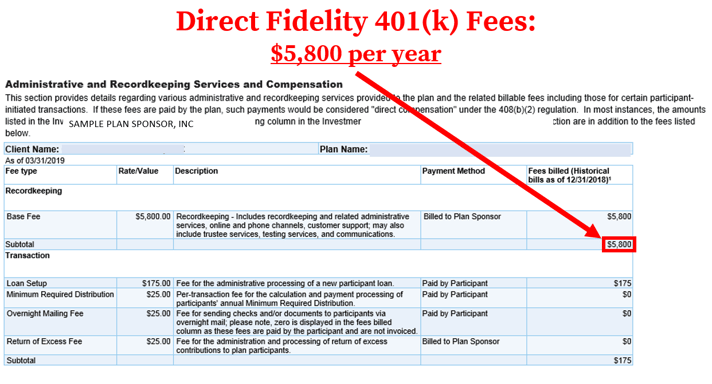

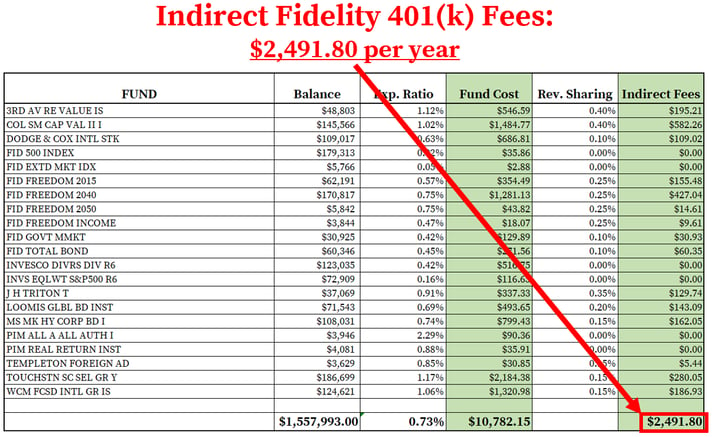

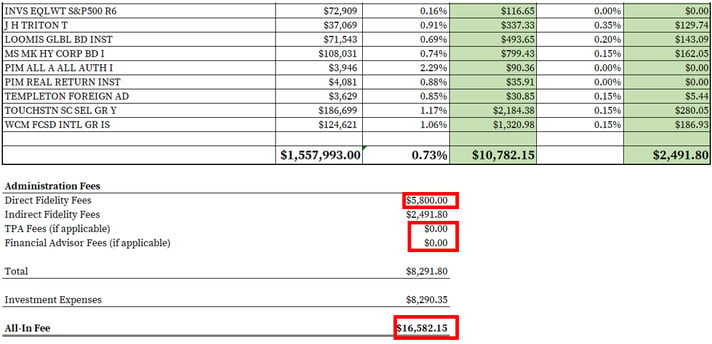

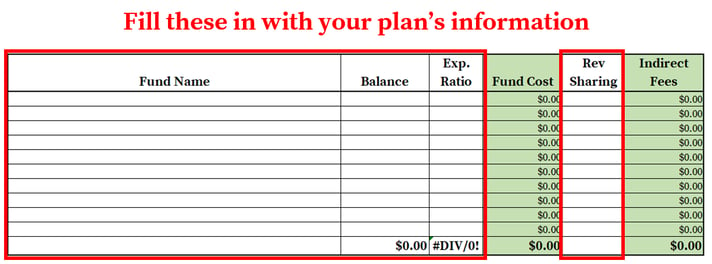

How To Find Calculate Fidelity 401 K Fees

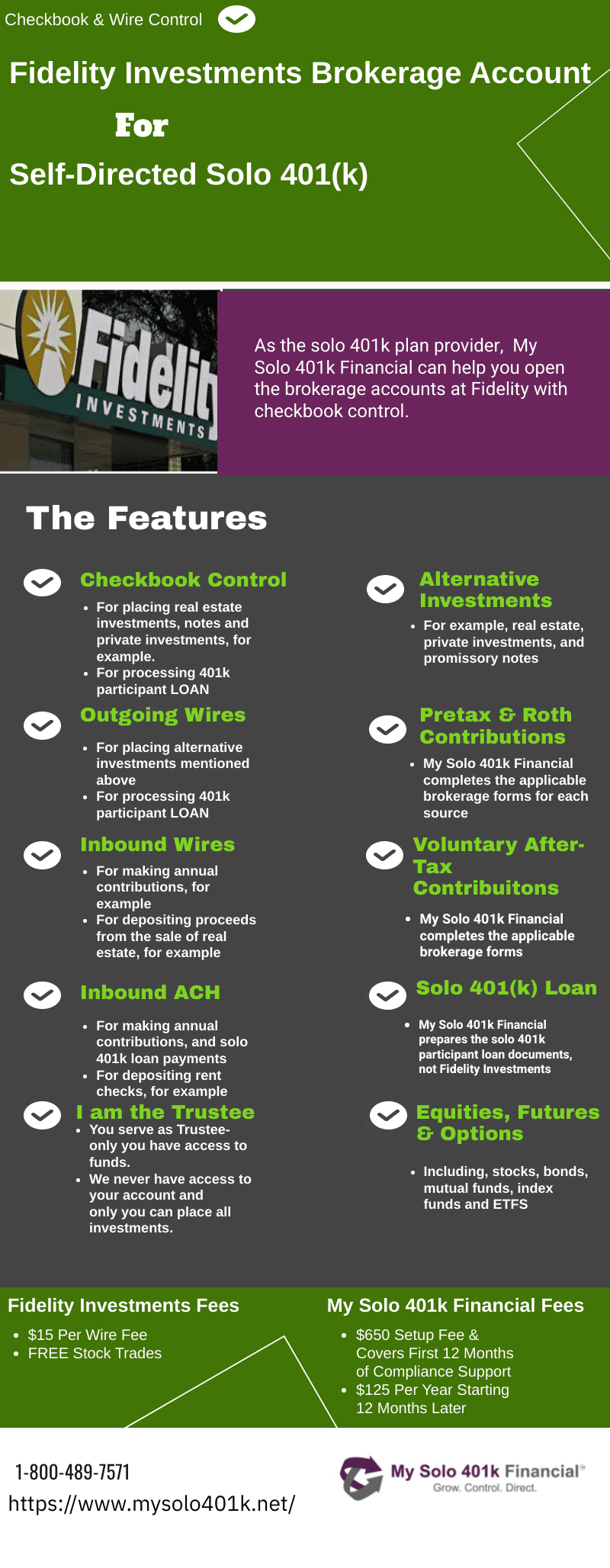

Fidelity Solo 401k Brokerage Account From My Solo 401k

How To Find Calculate Fidelity 401 K Fees

Roth 401k Roth Vs Traditional 401k Fidelity

K5ogqp86k Lmgm

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Roth Ira

How To Find Calculate Fidelity 401 K Fees

Fidelity Solo 401k Review Top Reasons To Change To A Self Directed Solo 401k Youtube

How To Find Calculate Fidelity 401 K Fees

How To Transfer A Former Employer 401k Plan Held At Fidelity Investments To A Self Directed Solo 401k My Solo 401k Financial

Financial Calculators Tools Fidelity

How To Find Calculate Fidelity 401 K Fees