What is the maximum you can borrow for a mortgage

Find out what you can borrow. Larger loans also known as jumbo.

Mortgage Points A Complete Guide Rocket Mortgage

Monthly payment for mortgage principal and interest.

. As a requirement you must make a 5 deposit and obtain a mortgage to shoulder 75 of the loan. This is a one-time fee that helps to cover the cost of the VA loan program. Costs associated with getting a mortgage.

Other types of funding include grants scholarships. Also if youre not planning in being in the home for 30 years its an option worth exploring. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income.

The HUD reverse mortgage loan to value ratio depends on the borrowers age the current interest rate and the value of the home. But in some cases that amount may be too generous. Mortgage Calculators.

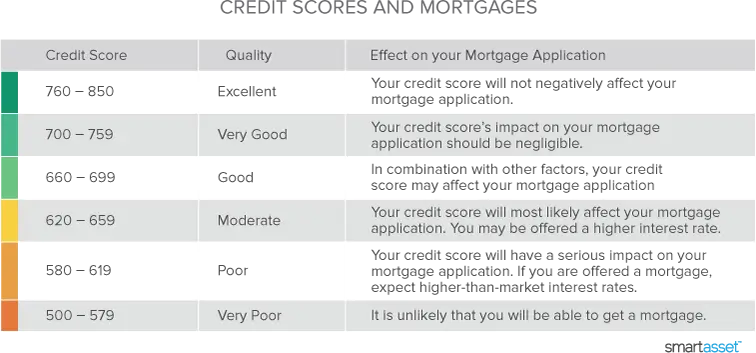

After performing the calculation you can transfer the results to our mortgage comparison calculator where you can compare all the latest mortgage rates. There are enough exceptions to say that credit policies can differ greatly from one bank to another. How much can you borrow from your 401k.

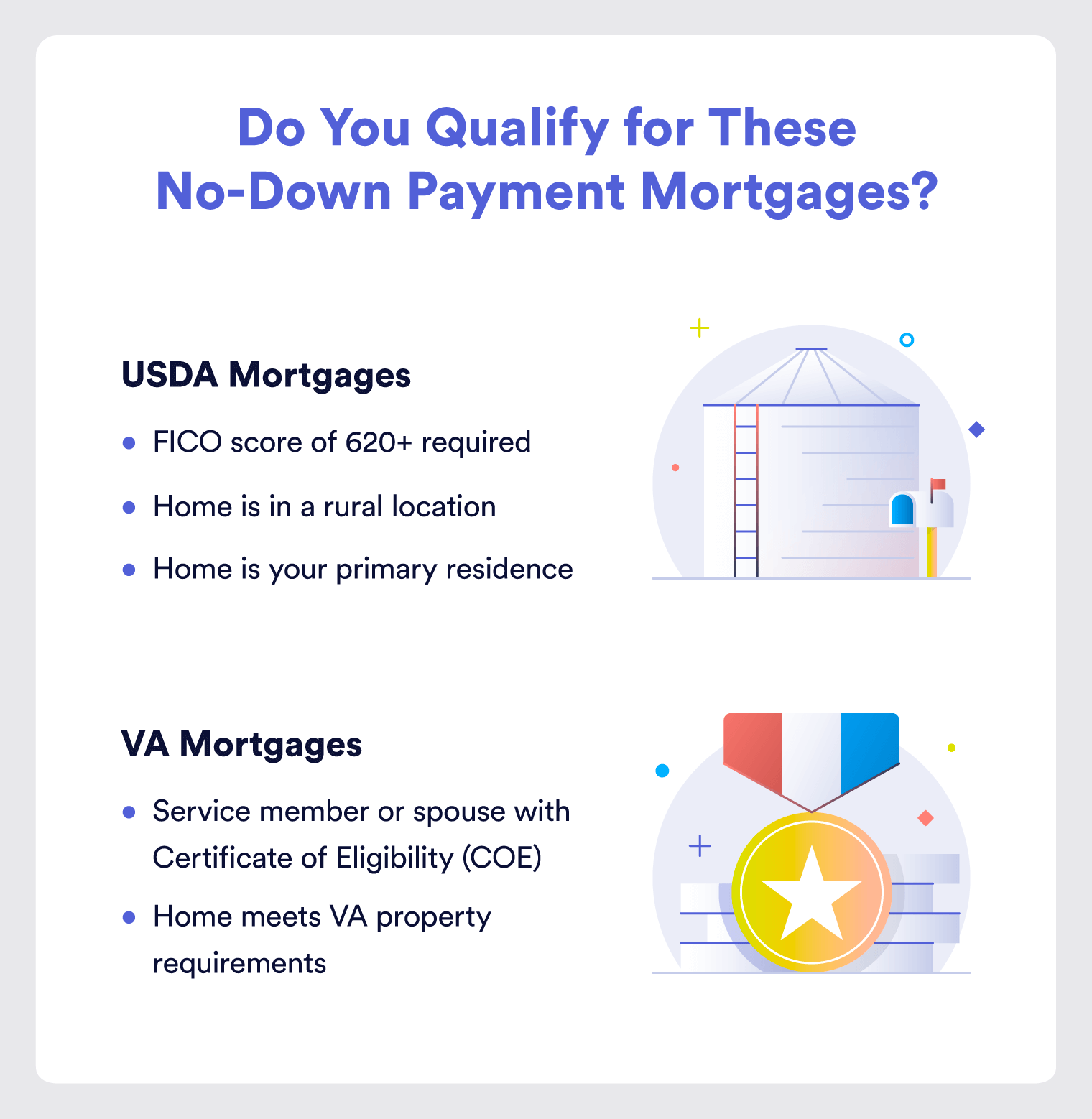

Value of the home you can afford 790800. The one trade-off for getting a 0 down payment mortgage is that when you get these loans youll have to pay the VA funding fee. Since you cant borrow from your IRA there are alternatives worth evaluating depending on your needs and the reason for your loan.

Calculate how much you can borrow. This means that the answer to the question How high can a FICO Score go is 900. Or 4 times your joint income if youre applying for a mortgage.

A reverse mortgage is a type of mortgage in which a homeowner can borrow money against the value of his or her home receiving funds in the form of a fixed monthly payment or a. You can then find out how much you could borrow. Subject to individual program loan limits.

So lets say you provide a 20 property deposit to avoid lenders mortgage insurance on a 30-year home loan. With an interest only mortgage you are not actually paying off any of the loan. First youll need to tell us the property value deposit and repayment term.

Then multiply that number by four to see the maximum amount you can borrow without having to make a down payment. For PLUS Loans the maximum amount you can borrow is the cost of attendance minus any other funding you receive. If you have student debt and are planning to buy a house the amount you can borrow on a mortgage will be lower because you have to be able to continue your monthly student debt payments as well.

Enter your details in the calculator to estimate the maximum mortgage you can borrow. Myth 3 Banks only lend up to 70 of your DSR. Remember getting the maximum FICO Score should not be a top priority when it comes to your finances.

However it may be possible to borrow from other types of retirement accounts such as 401ks. In general the maximum you can borrow is up to 80 of the available equity or the current value of your home minus what you owe on the mortgage otherwise known as loan-to-value ratio LTV. While you may be tempted to borrow from your IRA its not actually possible to get an IRA loan.

Avoid private mortgage insurance. When you put at least 20 down on a conventional loan or 20 home equity on a refinance you can avoid paying monthly private mortgage insurance premiums PMI. The house must also be bought from a builder recognized by the program.

If you take out a. With such a hefty down payment how many times your salary can you borrow for a mortgage. Maximum borrowing amounts can even differ up to 3x between different banks.

No mortgage insurance Reusable One-time VA funding fee can be included in the loan o If you receive VA disability com pensation you are exempt from the VA funding fee Minimum property requirements o Ensure the property is safe sanitary and sound VA staff assistance if you become delinquent on your loan. It allows you to build more equity faster and typically you can secure an ARM with a lower down payment. Myth 2 The maximum loan amount you can get from each bank doesnt vary much.

Some plans also have a minimum loan amount that can be requested. For 2019 the maximum reverse mortgage loan amount is 726525. You can find out more about which mortgage is right for you with our mortgage guide or give us a call to talk to one of our mortgage experts.

Based on these figures Australians can borrow between 15 to 18 less to buy a home. Capital and interest or interest only. Using the slider on the mortgage calculator you can see that this means you can afford to buy a house worth 233000 if you make a 20 down payment.

You can then see the results of the different mortgages you can apply for. You can borrow a minimum of 5 and a maximum of 20 40 in London of the propertys full price. Use our mortgage calculator to calculate your maximum mortgage with ABN AMRO in 2022 and get instant information on how much you can borrow.

If you calculate your affordability based on estimated payments will ask for information about your desired mortgage like the maximum monthly payment term. You should review your personal situation and work with your financial advisor to decide how much you can comfortably afford to borrow. An adjustable-rate mortgage is a great option for you if want a lower rate during the fixed portion of your mortgage.

By law 401k loans are limited to 50000 or 50 of your account balance whichever is less within a 12-month period. If you are deemed a qualified borrower a lender is prone to approve you for the maximum it believes you can afford. For example if youre using the 25 post-tax rule and you bring home 5000 per month that means sticking with a mortgage payment of up to 1250.

The mortgage should be fully paid off by the end of the full mortgage term. There are two different ways you can repay your mortgage. With a capital and interest option you pay off the loan as well as the interest on it.

Buying a home always means. Having a good very good or exceptional FICO Score should be more than enough to keep you in the running for a loan acceptance and decent interest rates. However the actual maximum amount you can borrow from your 401k may be less depending on what your plan allows.

Bwsoeu 8pgnfjm

Tips For Picking A Loan Term For Your Home Mortgage Home Mortgage Mortgage Mortgage Tips

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Mortgage Do S And Don Ts Mortgage Mortgage Tips Mortgage Advice

How Much Mortgage Can I Afford Smartasset Com

What Is 100 Mortgage Financing And How To Get It

Use Our Mortgagecalculator To Help You Set Your Budget Price Your Payments See How Making Additional Paym Home Buying Tips Mortgage Calculator Calculators

Why Be Preoccupied With What We Can T Achieve For The Time Being When We Can Become What We Can Live With Effort And Persistence In 2022 Persistence Achievement Effort

What You Need To Know About 401 K Loans Before You Take One

Great Information For You First Time Homebuyers Qualify For All Four Apply Here Loanfimortgage Com Understanding Mortgages Mortgage Bad Credit Mortgage

2022 Jumbo Loan Limits Ally

How Much A 200 000 Mortgage Will Cost You

1

How To Get A Mortgage Without Financially Freaking Out Mortgage Tips Freak Out Mortgage

Pin On Ontario Mortgage Financing

Kentucky Rural Housing Development Mortgage Guide For 2021 Usda Loans Kentucky Usda Mortgage Lender For Rural Housing Loa Usda Loan Mortgage Loans Home Loans

1